Worried concerning the cost of health insurance? You're not alone. Luckily, finding affordable coverage is easier than you think. With various options available, it can be difficult to know where to start. That's why we've made it our mission to guide you discover the perfect plan meeting your needs and budget.

Getting begun is simple! Just submit our quick and easy online form, and we'll present you with cost-free quotes from top-rated insurers in your area. You can then evaluate plans side by side to find the best value for your money. Don't delay - take control of your health and obtain a quote today!

Exploring Your Perfect Plan: Working with a Health Insurance Broker

Choosing the right health insurance plan can feel overwhelming. With so many alternatives available, it's easy to get lost in a maze of terminology. That's where a health insurance broker comes in. Brokers are professionals who know the intricacies of the health insurance industry. They can help you identify the plan that best meets your individual needs.

A broker will take the time to listen your situation and direct you through the process. They'll explain your options, analyze different plans, and advocate the best prices for you. By working with a broker, you can minimize time and worry while ensuring you have the security you need.

- Here are some of the perks of working with a health insurance broker:

• Skills: Brokers have in-depth knowledge of the health insurance industry and can supply valuable insights.

• Customizable Service: Brokers partner with you to discover a plan that matches your specific needs and budget.

• Effort Savings: Brokers handle the details of finding and comparing plans, freeing you to focus on other concerns.

Navigate Your Enrollment: Easy Health Insurance Sign-Up

Getting health insurance shouldn't be a struggle. We make it easy the enrollment so you can easily find the plan that best meets your expectations.

Here are a handful of tricks to make the sign-up effortless as possible:

* Determine your coverage. What are you looking for in a plan? Do you need comprehensive coverage?

* Analyze different options. Don't choose for the first option you see. Take your time and compare different options.

* Read the fine print. Understand what's covered and any {exclusions|.

Navigating Health Insurance Options and Costs

Embarking on the journey of finding suitable health insurance can feel complex, especially when confronted with a variety of options. Fortunately, understanding the different kinds of health insurance and their associated expenses doesn't have to be challenging. By meticulously examining your needs and researching available programs, you can arrive at a decision that best accommodates your budgetary situation and health goals.

- Begin by pinpointing your basic health protection needs. Consider factors such as amount of doctor's appointments, potential for medication use, and any current health situations.

- , Subsequently, contrast different plans based on their terms. Pay close attention to deductibles, premiums, and co-insurance arrangements

- , Ultimately, don't hesitate to speak to an insurance broker. They can provide specific recommendations based on your particular situation.

Navigating the Health Insurance Marketplace Made Simple

Finding an appropriate health insurance plan can feel like a challenging task. With so many options available, it's easy to become overwhelmed. But don't worry! Finding your way through the marketplace doesn't have to be troublesome. Here are some guidelines to make your journey simpler:

* **Start early**: Don't wait until the last minute to look for insurance. Give yourself plenty of time to evaluate multiple plans and choose one that fulfills your needs.

* **Determine your health needs**: Think about your existing condition and any potential medical requirements. This will help you target plans that provide the benefits you require.

* **Evaluate plans side-by-side**: Use online tools to compare different plans according to factors like monthly premiums, deductibles, copayments, and out-of-pocket maximums.

* **Don't hesitate to ask questions**: If you have any questions about a website plan, contact the insurance company immediately.

By following these guidelines, you can easily navigate the health insurance marketplace and choose a plan that is suitable to your needs.

Finding Affordable Healthcare Coverage: Finding the Right Fit for You

Accessing affordable healthcare coverage is crucial for everyone. With a variety of options available, it can be complex to determine the best fit for your needs and budget. Thankfully, there are resources available to help you evaluate different plans and find coverage that meets your requirements.

Begin by evaluating your healthcare needs, such as how often you need doctor's visits and prescription medications. Next, consider factors like costs associated with coverage.

Utilize online tools and comparison websites to contrast different plans from various providers. Be sure to reach out to insurance brokers or health care specialists for advice tailored to your situation. By taking the time to research your options, you can achieve affordable healthcare coverage that provides financial security.

Josh Saviano Then & Now!

Josh Saviano Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Andrew McCarthy Then & Now!

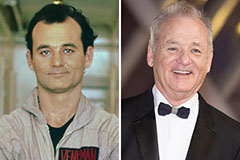

Andrew McCarthy Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!